income tax rates 2022 ireland

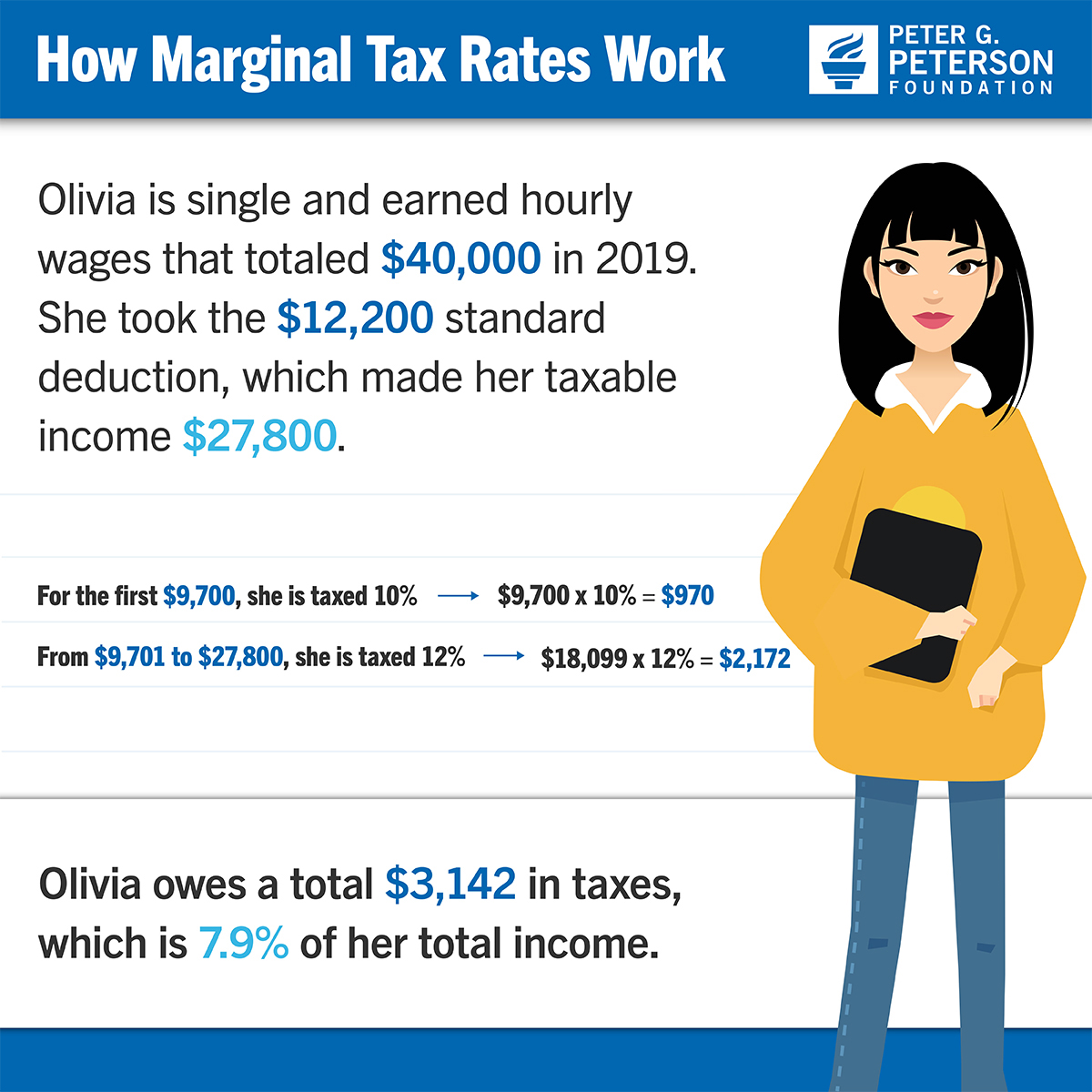

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. In 2022 for a single person with an income of 25000 the effective tax rate will be 120 rising to 198 at an.

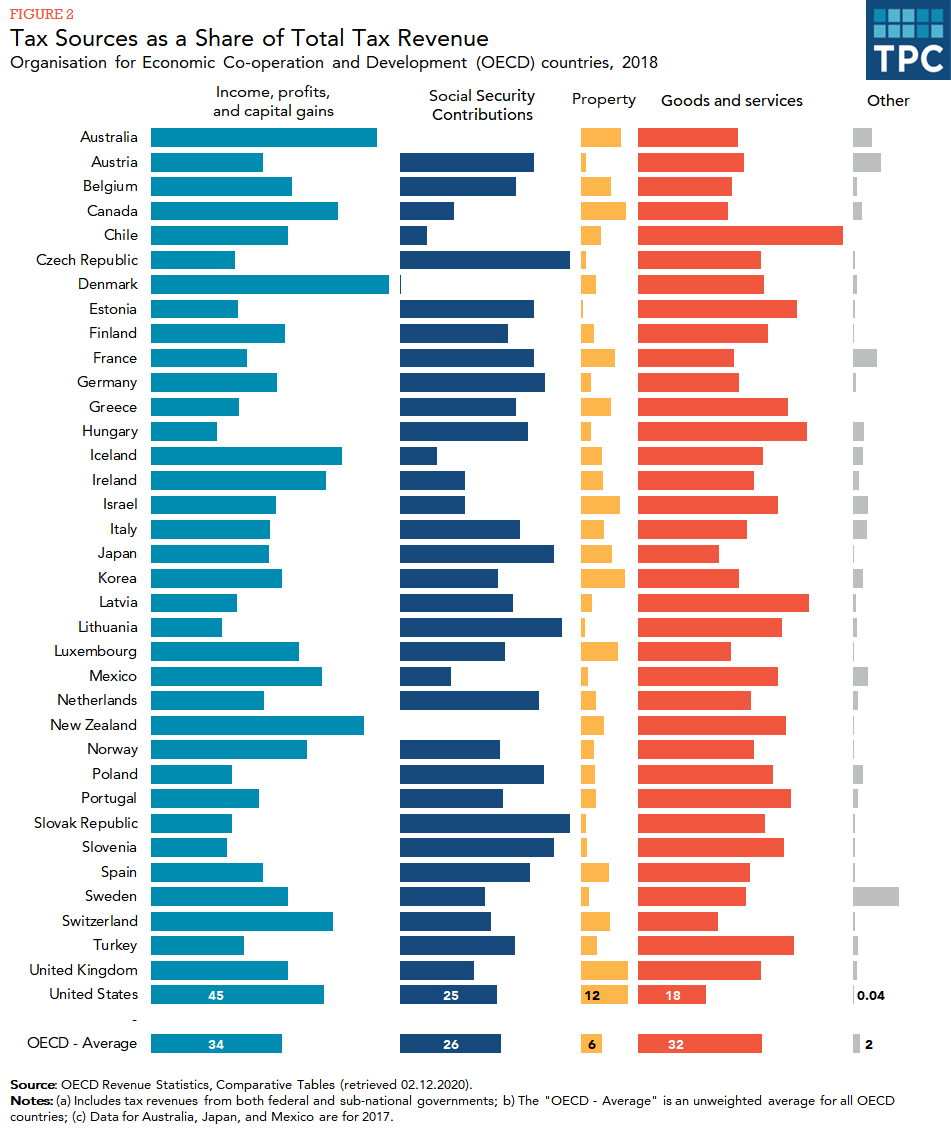

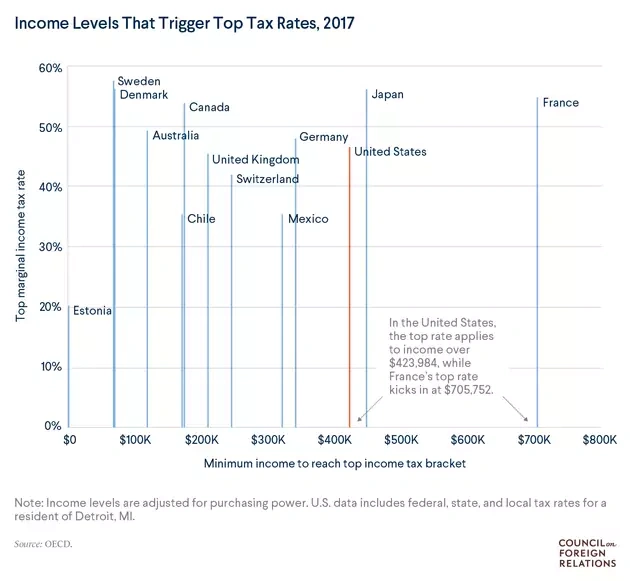

How Do Us Taxes Compare Internationally Tax Policy Center

The personal income tax system in Ireland is a progressive tax system.

. Income up to 36800. Your income up to a certain limit is taxed at the standard rate of Income Tax which is currently 20. 5 Oct 2022 How Much Tax Do I Pay On 60000 In Ireland.

Minister for Finance Paschal Donohoe said 20 per cent income tax rate would be extended to cover income up to 40000 for a single person up by 3200 from 36800 this year. Some tax systems collect income taxes based on a progressive scheme while others may. Social insurance is 4 on all.

1 The minimum wage in Ireland in 2022 2 The Irish national average salary in 2022 Gross Salary Take-Home Pay Effective Tax Rate Tax Due. Balance of income over 36800. 2022 EUR Tax at 20.

Tax Bracket yearly earnings Tax Rate 0 - 36400. Below is the 780 a Week After Tax IE calculation assuming your working week is 40 hours. The tax credit for 2022 can be claimed from early 2023 Further cost of living measures such as a reduction in college fees free school books and reductions in child care costs do not directly.

This is monthly after-tax income of 2887 EUR and 3102 EUR respectively. Its smaller if your income is over 100000. News Analysis as of November 2 2022.

Scroll down to find the detailed breakdown of how much 780 a week after Tax is in Ireland for the. Finance Bill 2022 the Bill was published on 20 October and includes the legislative provisions implementing the tax measures announced as part of Budget 2023 as. Ireland has a bracketed income tax system with two income tax brackets ranging from a low of.

On September 27 2022 the Director of the Iowa Department of Revenue issued Order 2022-03 certifying that the top corporate income tax rates will be reduced to 84 from 90 and 98. Single and widowed person. Sales Tax Rate 2300.

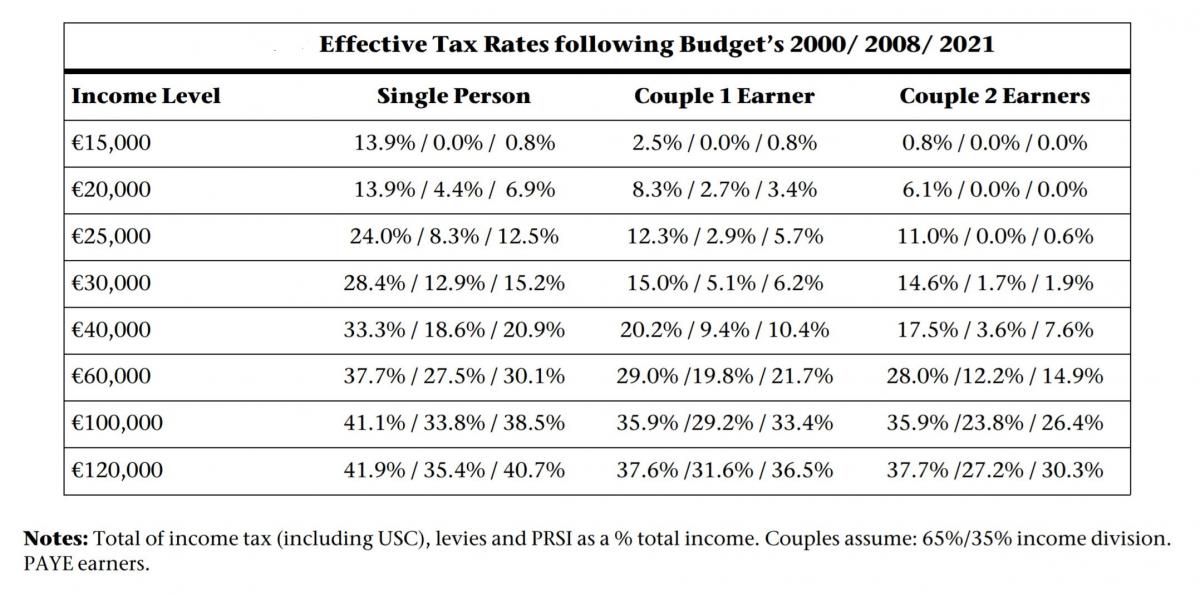

Standard rate of tax. Review the 2022 Iceland income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions pension contributions and other salary. Based on Budget 2022 we calculated effective tax rates for a single person a single income pair and a two-earner couple.

Income Taxes Ireland Tax Rates. As well as income tax other deductions are taken. In the year 2022 in Ireland 760 a week gross salary after-tax is 31895 annual 2658 monthly 61128 weekly 12226 daily and 1528 hourly gross based on the information.

Social Security Rate 1505. A brief summary of the Income Tax Rates in Ireland is given below the figures shown are valid from January 2022. Your monthly take-home pay will be 29.

Personal circumstances 2022 2021 2020 2019 2018 Single or widowed or surviving civil partner without qualifying children. The Ireland Income Tax Calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator please note these income tax tables only include. On income tax Paschald announces increase in the Standard Rate Cut Off Point to 40000 increases in the main tax credits Personal Employee and Earned Income Credit.

After that the first income tax rate is 20 until the so-called Standard Rate cut-off point of 36800. Table 1 presents the results of this analysis. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting.

Income Tax rates and bands. Beyond that any extra income is taxed at 40. The current tax rates are 20 and 40.

Personal Income Tax Rate 4000. Corporate Tax Rate 1250. The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570.

Rates and bands for the years 2018 to 2022.

The History Of Taxes Here S How High Today S Rates Really Are

Taxes Income Tax Tax Rates Tax Updates Business News Economy 2022

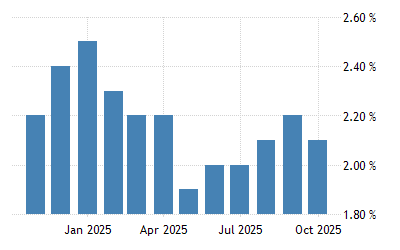

Euro Area Inflation Rate October 2022 Data 1991 2021 Historical

Taxation In The Republic Of Ireland Wikipedia

Taxation In The Republic Of Ireland Wikipedia

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Amazon Avoids More Than 5 Billion In Corporate Income Taxes Reports 6 Percent Tax Rate On 35 Billion Of Us Income Itep

Taxation In The Republic Of Ireland Wikipedia

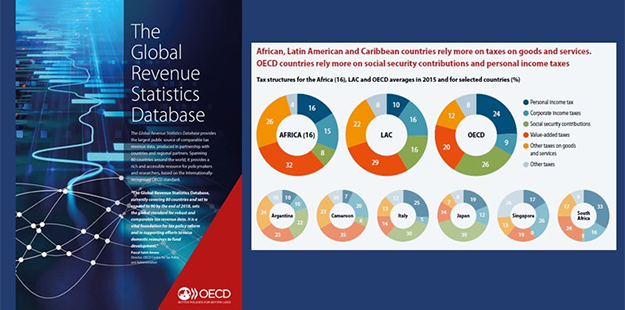

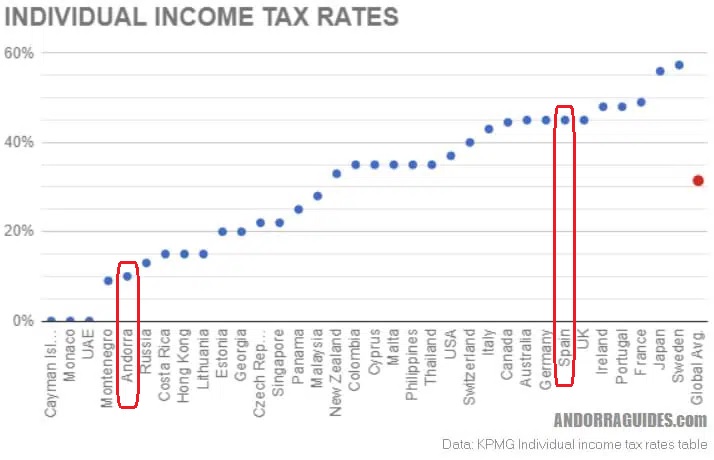

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

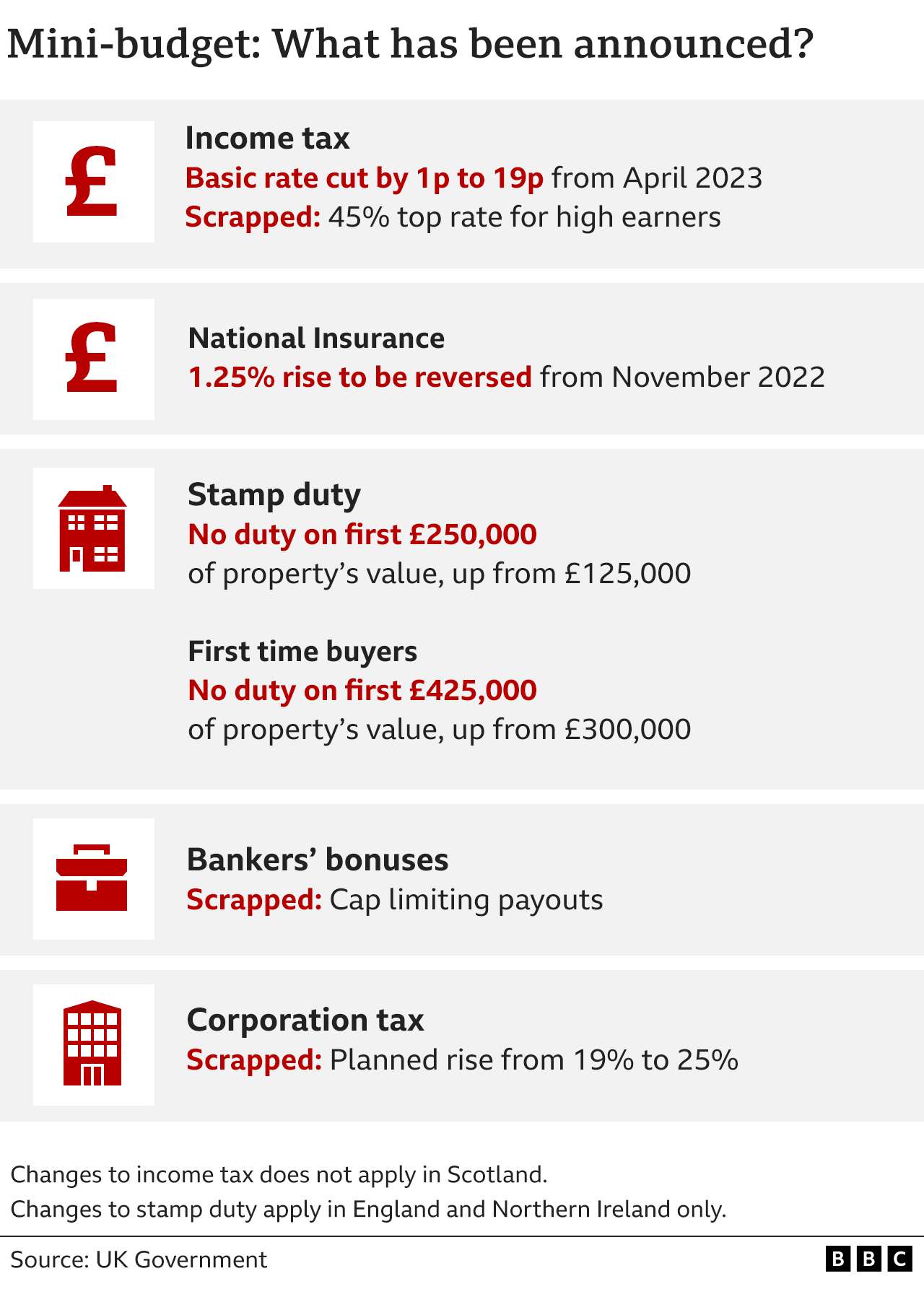

Mini Budget Favours Wealthy Over Workers Says Murphy Bbc News

15 Countries With The Highest Tax Rates In The World In 2022

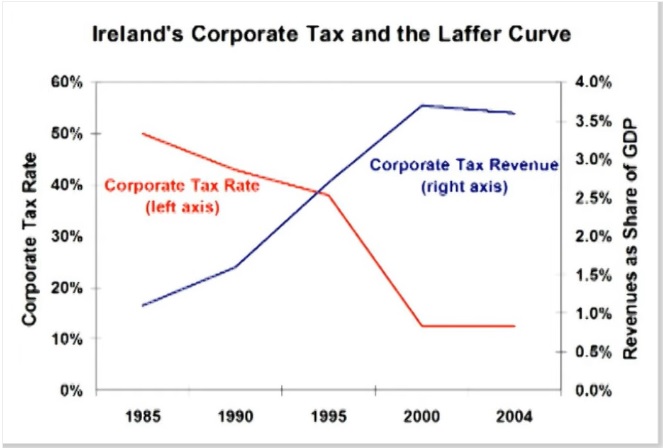

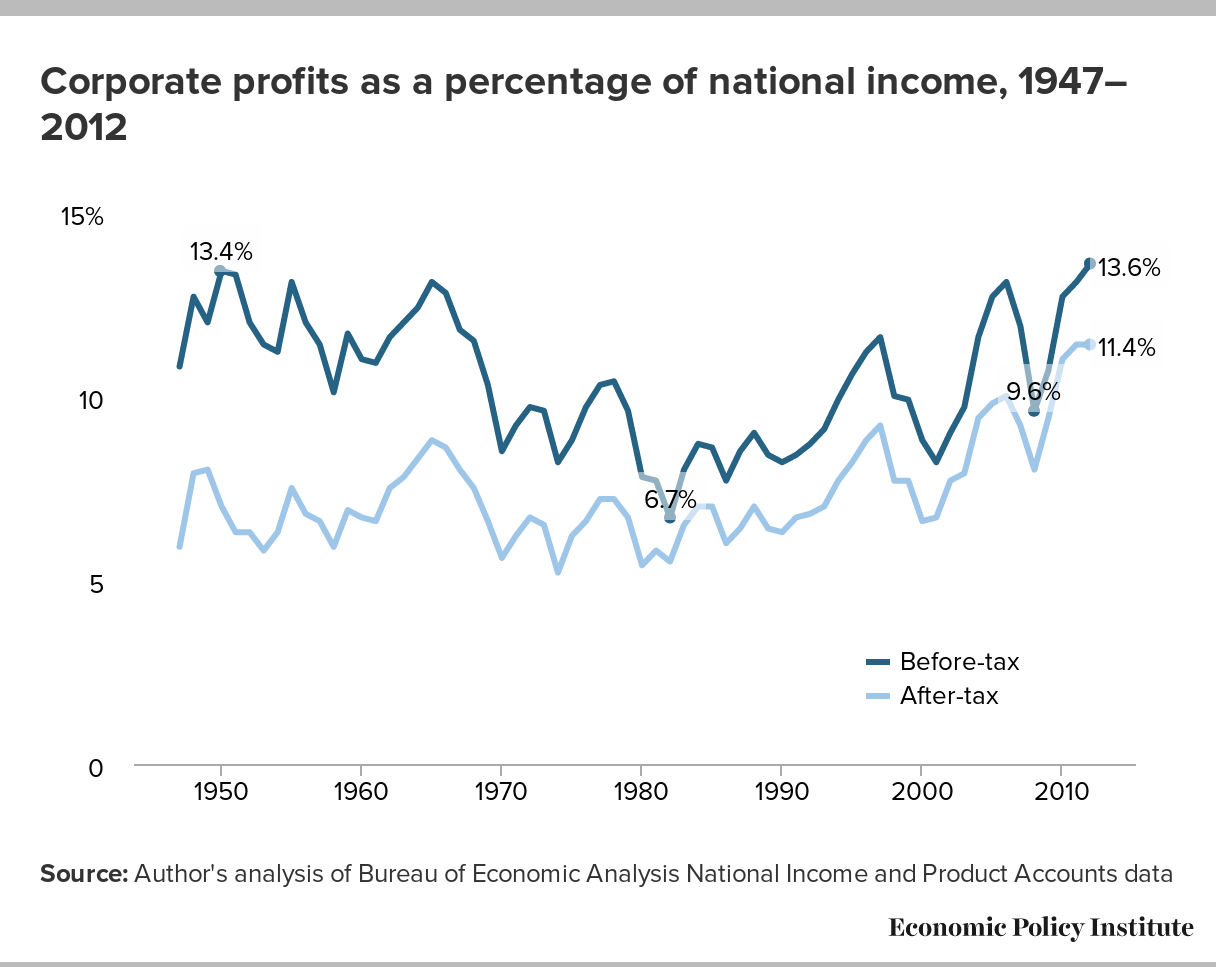

Corporate Tax Rates And Taxable Income International Liberty

Corporate Tax Rates Around The World Tax Foundation

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Ireland Personal Income Tax Rate 2022 Take Profit Org

Learning From Andorra S Tax System International Liberty

What Is The Difference Between The Statutory And Effective Tax Rate

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute